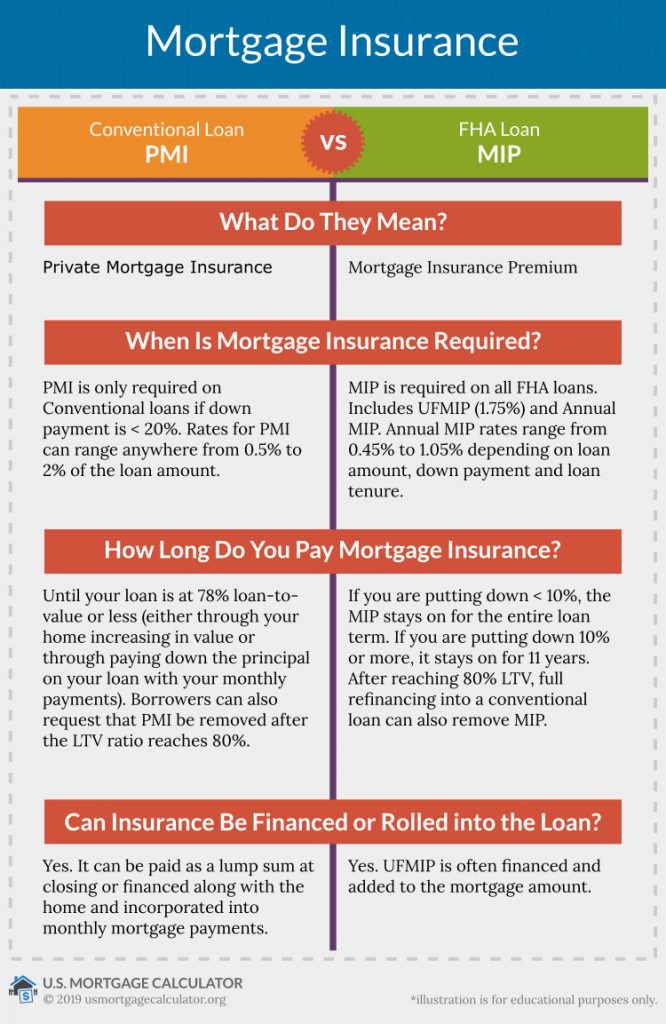

**VA funding fee is 2.3% for a first-time home buyer purchase zero down and up to 3.6% for subsequent usesĮach loan type has a different mortgage insurance rate, even for the exact same loan size. *Mortgage insurance rates are shown as a percentage of the loan amount The initial fee is usually higher, but it’s paid only once - when the loan closes.Ĭosts for both types vary by loan program: Some home loan types also charge an upfront mortgage insurance fee, which can often be rolled into the loan balance so you do not have to pay it at closing.įor most loan types, there are two mortgage insurance rates: An annual rate and an initial rate or “fee.” Your PMI rate will depend on your loan size, credit score, down payment amount, and debt-to-income ratio. This annual premium is broken into monthly installments, which are added to your monthly mortgage payment.

But in general, the cost of private mortgage insurance, or PMI, is about 0.5 to 1.5% of the loan amount per year. Mortgage insurance costs vary by loan program (see the table below). It’s a ticket out of renting and into equity wealth. But you could start gaining tens of thousands per year in home equity.įor many people, PMI is worth it. You might pay more than $100 per month for PMI. Mortgage insurance can help you buy a house sooner. Why? Because unlike homeowners insurance, mortgage insurance protects the lender rather than the borrower.īut there’s another way to look at it. Many homebuyers try to avoid PMI at all costs. Private mortgage insurance (PMI) is usually required if you put less than 20% down on a conventional loan. Febru10 min read Is mortgage insurance a bad thing?

0 kommentar(er)

0 kommentar(er)